Finance

- Low Rate Finance Available with Same Day Driveaway

- Buy now & pay nothing for 2 months*

- Zero deposit required

- Use our FREE credit check tool before you apply*

Your Monthly Payments

- Why Apply

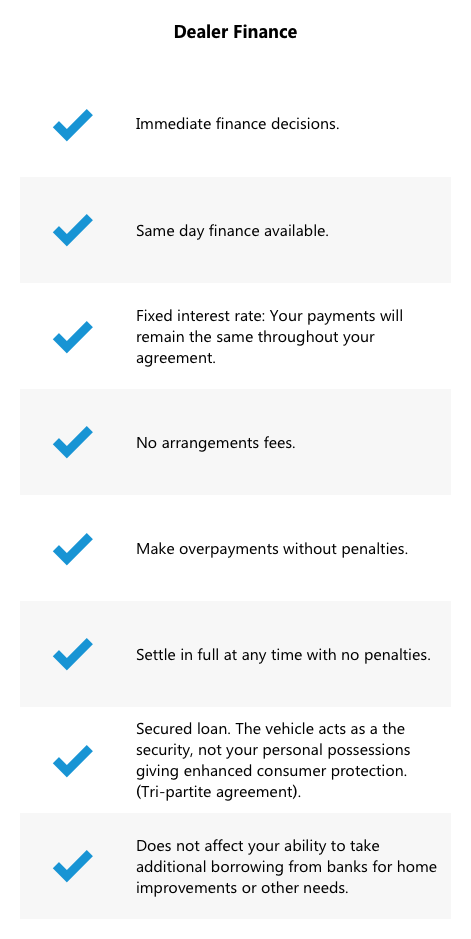

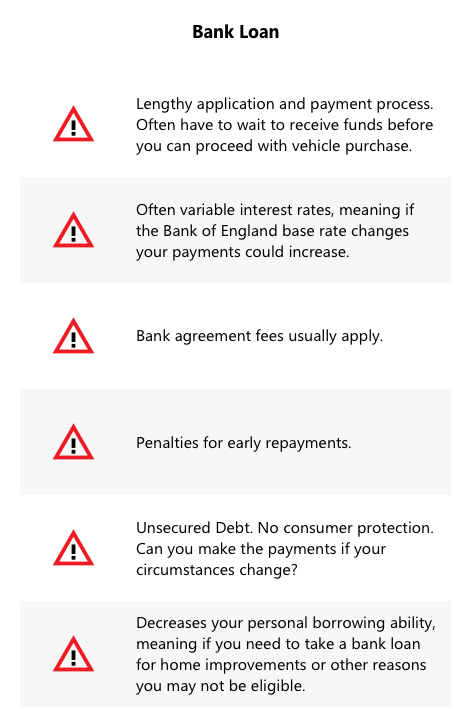

- Why Dealer Finance

Simple Finance Made Easy

Our finance system works in the same way as many high street banks and if you decide to finance your purchase via our lender you will receive a personalised quote dependent on the amount you intend to borrow and your personal credit score. Many car dealerships simply have one set interest rate (APR) to offer, however at Avalon you will receive the most competitive interest rate we can offer you based on the amount you wish to borrow and your personal credit score. Let us take away the stress and hassle of arranging your loan. Our sales team are fully trained and can walk you through the full process. We can complete the entire application process for you in as little as 10 minutes and providing it’s prior to 3pm we can have the finance paid out in under 1 hour meaning you can drive away on the same day.

Apply online today

Apply for your used car finance 24/7 right here on our website. Simply find the vehicle of your choice and follow the on-screen instructions. You can also apply over the phone during our office hours or in person at our showroom.

Check whether you will be accepted before you apply

Without harming your credit score, use our free finance check tool to check your likelihood of being accepted for finance prior to completing a full application. This is a great way to check if you are likely to be accepted by our lender without causing any harm to your credit score.

Why choose dealer finance over a bank or personal loan?

What happens if you have a vehicle to part exchange which has outstanding finance?

No need to worry. We will simply value your vehicle and then need to know the total outstanding amount you owe on your current finance agreement. This is commonly known as your settlement figure.

If the value of your current car is above the amount you owe then you will have some equity which you can use as a deposit against the finance on the car you are buying.

If the value of the car is lower than the amount you owe then this is called negative equity. In this scenario, you may be required to put in a deposit to assist with covering this difference. If you cannot afford to pay the difference then in many cases we can assist with this by incorporating this difference in the loan application for the car you are purchasing.